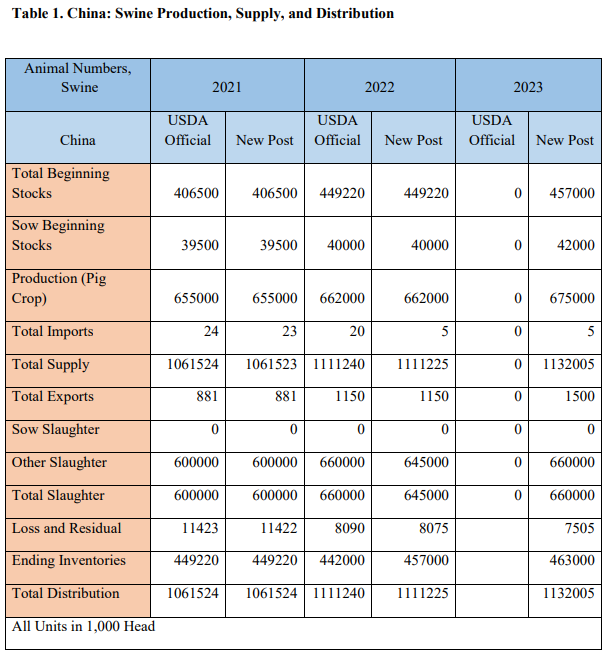

In 2023, imports of breeding swine and pork are expected to decline to 5,000 head and 1.85 million metric tons (MMT), respectively, due to lower domestic hog and pork prices. Strong carryover stocks of beef cattle from 2022 into 2023 will support an increase in cattle and beef production to 52.575 million head and 7.4 MMT, respectively. Imports of cattle and beef are forecast to decline to 300 thousand head and 2.5 MMT, respectively, in 2023 on a less optimistic economic outlook, COVID-19 restrictions and uncertainty in the HRI sector, and tight global supplies.

Swine

Imports of live breeding swine in 2023 are estimated at 5,000 head. Imports will be pressured by lower hog and pork prices in 2023. Additionally, higher transportation costs for transporting breeding swine, stringent import quarantine and testing requirements, and ongoing COVID19 restrictions for airline crew entering China are expected to weigh on imports.

In 2023, live swine imports are estimated to reach 5,000 head. In 2023, the high costs and difficulties associated with importing live breeding swine will weigh heavily on imports, which are expected to reach 5,000 head – primarily from the United States, Denmark, and France. In 2023, hog producers are expected to rely on local herds, genetics, and commercial breeding sows to support production goals.

Importing live swine requires extensive planning and capital investments. In the first half of 2022, China’s imports of live swine dropped over 90 percent to just over 1,750 head. Total live swine imports for 2022 are not expected to exceed 5,000 head. In 2020 and 2021, high domestic hog prices and strong pork demand drove a surge in imports. However, as demand and domestic prices have weakened companies are expected to be less motivated to take on the high cost of transport, quarantine, and delivery for imported breeding swine.

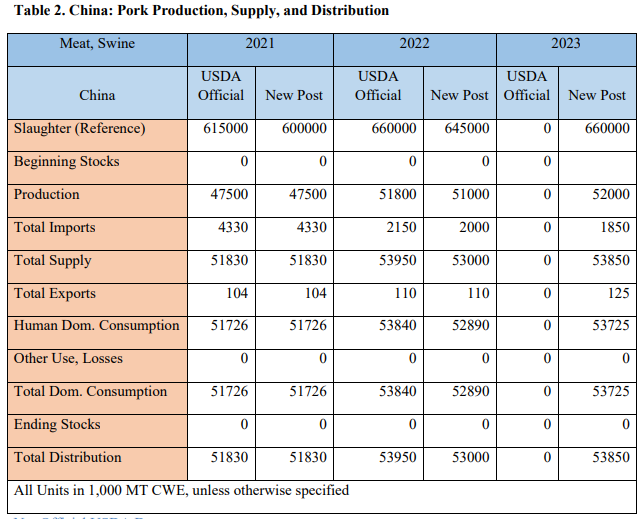

Pork

Pork imports in 2023 are forecast at 1.85 MMT, an 8 percent decline compared to the revised estimate for 2022. The import estimate for 2022 has also been lowered, by more than half from the previous estimate published in the FAS China semi-annual report. Pork imports in 2023 are expected to decline from strong levels witnessed in the last few years as domestic production and prices stabilize. Additionally, imports are expected to be constrained as global pork prices are less competitive compared to domestic prices.

Imports in 2023 expected to drop to 1.85 MMT. In 2023, imports of pork products are forecast to decline 8 percent to 1.85 MMT. In 2022, strong domestic hog production and weaker consumer demand lowered domestic pork prices. In the first half of 2022, pork imports fell by over 60 percent, to 1.1 MMT. In 2023, ample domestic production and lower domestic prices are expected to curb pork imports. Post lowered 2022 import estimates from its earlier report in line with ongoing trends. High transportation and energy costs, along with higher global pork prices are expected to reduce the competitiveness of imported products. COVID-19 testing, disinfection and certification measures remain in effect across China putting an additional burden on imported products to clear customs and cross provincial borders.

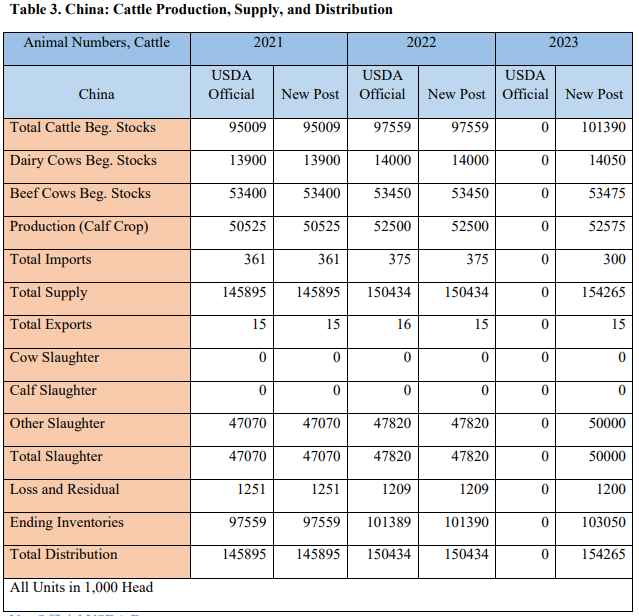

Cattle

Imports are expected to decline to 300 thousand head due to a ban on New Zealand live cattle exports by sea that is scheduled to enter into force in April 2023. Additionally, South American exports are expected to decline due to tight supplies, exports of beef cattle for breeding over dairy cattle, and strong demand in local markets.

Cattle imports to decline in 2023 to 300 thousand head. Cattle imports from South America are expected to remain lower for differing reasons. Uruguayan cattle exports to China are shifting to high quality beef cattle for breeding (over dairy cattle), which will lower exports. Argentinian and Chilean live cattle exports are expected to decline as domestic prices rise, transportation and inputs cost increase, and local supplies tighten. Overall imports will decline, due to the anticipated implementation of a ban on exports of New Zealand live cattle by sea, a major live cattle exporter. Consequently, imports from Australia will dominate the market – with the potential for additional growth compared to 2022.

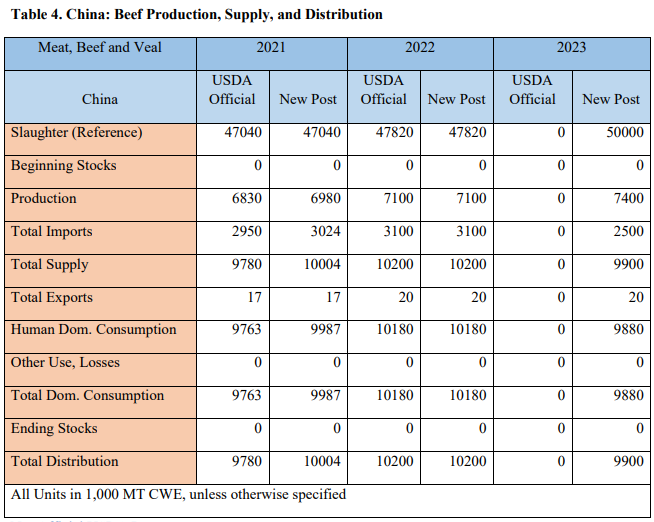

Beef

In 2023, imports of beef are expected to decline to 2.5 MMT on high global beef prices, lower domestic prices, and a weaker economy impacting consumers purchasing decisions of high value products such as imported beef.

In 2023, beef imports expected to decline on a weak economy, uncertainty on COVID-19 restrictions In 2023, imports of beef products are expected to decline to 2.5 MMT primarily due to a weak economy and uncertainty in the HRI sector caused by ongoing COVID-19 restrictions. Strong global beef prices in 2023 and losses suffered by speculative importers in 2022 are also expected to weigh on import volumes in 2023.

In 2022, importers stocked up on beef products just as PRC officials instituted COVID-19 lockdowns across major cities and the economy slowed. In the first half of 2022, beef import prices grew by over 37 percent causing difficulties for many beef importers. In the second half of 2022, sources note that some importers may decide to sell below their purchase price to avoid refrigeration and storage costs.

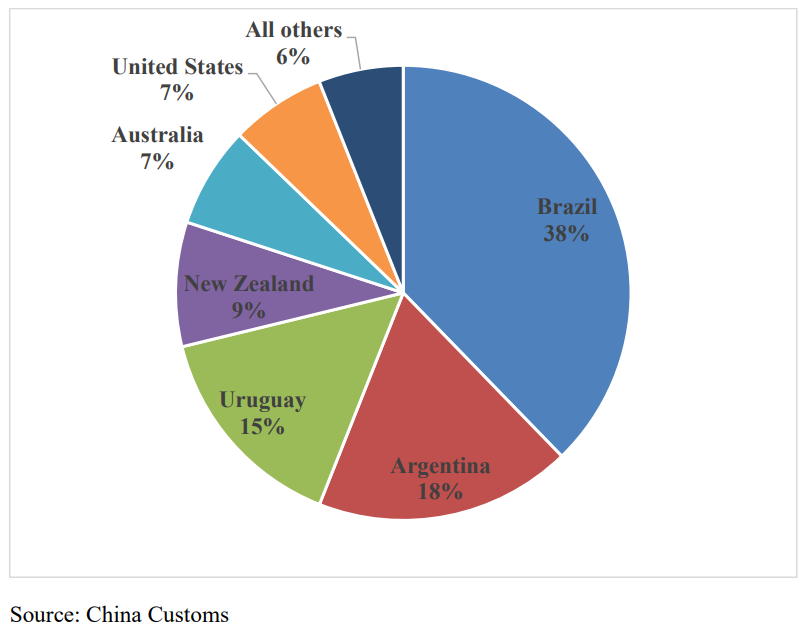

China’s imported beef market is dominated by Brazil, Argentina, Uruguay, New Zealand, Australia, and the United States (see CHART below). As noted in the Pork Trade section above COVID-19 testing, disinfection and certification measures remain in effect across China putting an additional burden on imported products, including beef, to clear customs and cross provincial borders. In 2022, GACC suspended meat facilities from multiple countries for reasons including alleged COVID-19 detections on outer packaging, video inspections, and other reported reasons. In August 2022, GACC temporarily suspended two U.S. beef facilities from presenting beef for customs clearance.

Source: USDA

Note: This article is compiled by Antion, please indicate our source if reprint it.