During the supply chain disruptions resulting from the COVID-19 pandemic, milk imports declined by 17 percent in MY 2021, pushing local producers to exceed production expectations to meet high demand. Demand for fluid milk continues to rise due to food/beverage trends and changing consumer preferences. At the same time, Chinese Taiwan milk producers are bracing for the impact of unlimited zero-tariff milk from New Zealand in 2025. Butter imports have also been subject to supply interruptions. However, total butter import volume remained relatively unchanged.

Milk, Fluid

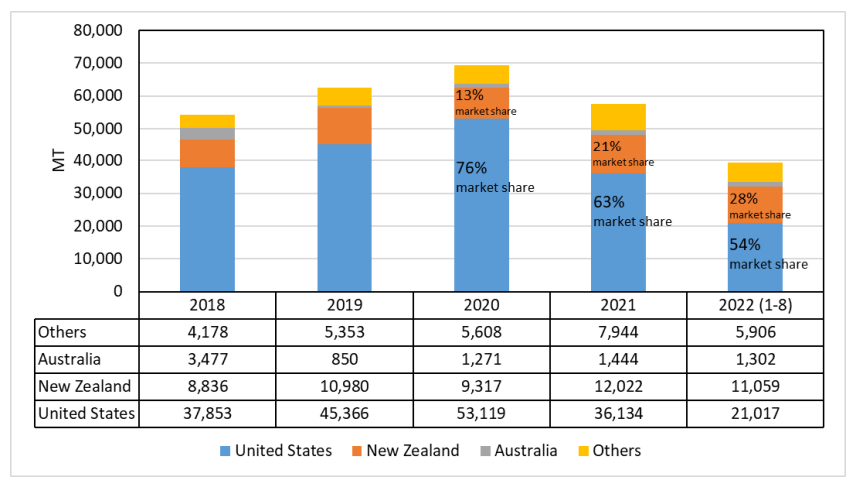

In the second half of MY 2021, due to global supply chain issues and severe port congestion, Chinese Taiwan importers often received expired or very limited shelf-life fluid milk. Since then, importers are hesitant to import fluid milk. The United States is the dominant supplier of imported fluid milk, while several brands from New Zealand and Australia entered the market during this upheaval. In MY 2022 to date, the U.S. share of the import market is 54 percent, down from 76 percent in 2020.

Chinese Taiwan's top five dairy processors have an 85 percent share of the local fresh milk market. Small local dairy farm brands capture about 12 percent market share. The Milk House label's success highlights Chinese Taiwan consumers' preference for traceability, sustainability, and single-origin dairy product. Capitalizing on this trend, major supermarket chain PXMart promotes dedicated shelf space for small dairy farm brands. The major milk processors have also begun to launch some single-origin milk products.

Figure 1: Chinese Taiwan Fluid Milk Imports by Volume, 2018-2022

Melamine and veterinary drug residues are prohibited in milk and milk products. Chinese Taiwan requires that imports of U.S.-origin fresh milk and milk products be accompanied by a Veterinary Service (VS) 16-4 export certificate for animal products.

Dry Whole Milk Powder (WMP) and Skim Milk Powder (SMP)

Chinese Taiwan's milk powder imports are extremely stable; there is no significant fluctuation of milk powder demand or supply. MY 2022 WMP imports are expected flat at 36,000 MT based on year-to-date data; SMP imports are also essentially flat at 24,000 MT. The MY 2023 forecast is left unchanged. New Zealand is Chinese Taiwan's dominant supplier milk powder. Over 96 percent (34,678 MT) of WMP and 77 percent (19,291 MT) of SMP imports came from New Zealand. Belgium had 9 percent (2,322 MT) and Australia had 6 percent (1,672 MT) market share of skim milk powder in MY 2021. The price of imported milk powder increased to over USD $4/kg in April 2022 and remains high. Among all the suppliers, New Zealand's milk powder is the most expensive, with an average price of USD $4.25/kg.

Butter

New Zealand is the leading exporter of butter to Taiwan, followed by France. The United States is the fifth-largest supplier. Since the start of the COVID-19 pandemic, Chinese Taiwan's butter supply has not been as stable as before. The past two years have seen some temporary supply shortages. Furthermore, butter's price continues to rise; Chinese Taiwan's butter CIF price has risen 20 percent in the past three years. Nevertheless, imports are forecast stable and increasing slightly on gradually increasing demand.

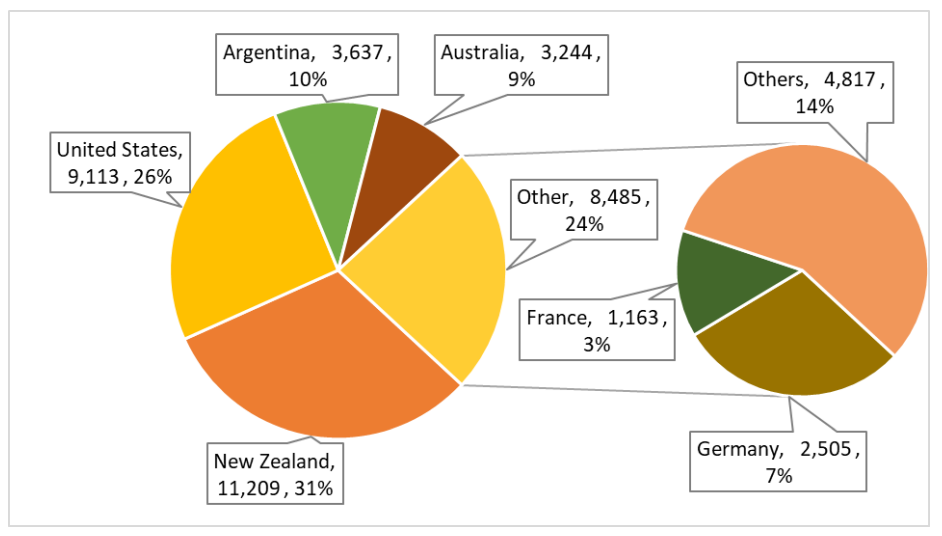

Figure 2: Chinese Taiwan Butter Imports by Country

Cheese

Chinese Taiwan imports cheese mainly from New Zealand, the United States, Argentina, and Australia. New Zealand is the largest cheese supplier by value (31 percent) while the United States is the second largest with 26 percent market share. Argentina is graining rapidly in the market with 10 percent currently.

Figure 3: Chinese Taiwan Cheese Import Value by Country

Source: USDA

Note: This article is compiled by Antion, please indicate our source if reprint it.